A Fortune 500 Global Data Analytics Company is a prominent supplier of regulatory and business insights and analytics, helping professionals worldwide enhance decision-making, boost efficiency, and improve client service. With thousands of employees across many products and clients, keeping track of all their contract positions and obligations is unwieldy.

However, once they created a single source of truth, Finance and Commercial Sales found unique use cases to leverage contract data to plug revenue leakage and generate new revenue generation strategies. The results were almost immediate. Between both teams, they surfaced $400,000 in missed revenue from just a handful of contracts.

The Challenge

A Fortune 500 Global Data Analytics Company offers its customers ready access to essential business intelligence that reduces risks and uncovers key insights that significantly improve decision-making and drive growth. They equip their customers with cutting-edge technologies, analytics, and services for managing data that aid in problem-solving, enhance decision quality, ensure compliance, minimize risks, and optimize operations.

They serve a global customer base built over decades in their industry and, as a result, manage thousands of commercial contracts across legacy systems. These systems are antiquated and often require specialized coding, making the process of locating contracts slow and inefficient. If a user can’t find a contract or has a question about it, they must send their query to a team overseas using a ticketing system. This team then looks through various in-house systems to find the contract and answer the question. This process can take days or weeks, especially if the user has follow-up questions. To drive efficiency and remove barriers, the company needed a modernized post-signature contract management solution that was nimble, comprehensive, and adaptable across business units with the explicit benefit of enabling users to think more strategically about how to leverage contract data to meet their business objectives.

Solution

Choosing Knowable provided a unique opportunity to help various teams harness the potential of contract data, focusing on one business unit at a time. The initial step involved identifying key individuals within the organization who realized the importance of the information in their contracts and the numerous advantages that come from understanding their contents.

For the Finance and Sales teams, gaining quick access to contracts was essential to their daily operations. As most companies prioritize revenue growth, initiating the partnership with Finance and Sales was a strategic move as both teams recognized that their contracts contained untapped revenue opportunities; they just needed a more efficient way to unearth them.

The Head of Finance Transformation was the first to take on the challenge of finding missing revenue. Soon after, the VP of Large Accounts and the VP of Mid-Market Accounts also began using Knowable, each in their own way, to achieve their strategic goals.

The Approach

Finance led the way.

During a migration from a legacy platform onto a new one, the Finance team identified disparity in their data quality, particularly around customer value. Over the years, they received complaints from customers about overbilling, prompting them to question if they were also experiencing revenue loss due to underbilling. Understanding that contracts contained the most reliable data regarding their customer relationships, they initiated an exercise to validate the effectiveness of customer billing.

This was important because they boast a high rate of return on new customers and an impressive 91% retention rate for renewals. As a subscription-based business securing these deals early allows them to recognize revenue that impacts their annual performance. Moreover, with substantial potential for upselling, it’s crucial for them to gain better insights into their positions to minimize the risk of cancellations. However, their existing systems and processes have proven to be challenging in achieving this goal.

The Finance team faced two key obstacles —inefficient invoicing processes and difficulty reconciling accounts.

Verifying Contractual Payment Terms at Scale: Initially, the team endeavored to validate invoices against 50 contracts, which they thought to be a simple mission. However, locating these contracts proved to be a daunting two-week task, given their scattered presence across emails and various SharePoint sites. This process consumed considerable time, making the prospect of scaling it to validate 2,000 or more contracts almost unfeasible, especially when factoring in the team’s ongoing daily responsibilities.

Tackling Process Challenges to Enhance Subscription Value: It was vital for the team to proactively discuss contract terms that provided insight into the value of multi-year subscriptions, potential upsell opportunities, and what leverage they may have for renewals. However, due to the limitations of their current process, the team struggled to engage in these conversations, which hindered their ability to demonstrate value to customers.

The Finance team worked with Knowable to develop a comprehensive data model to track key contract elements including payment terms, price increases, pricing terms, termination details, renewal information and more. This gave the team valuable insights into both standard and non-standard terms and positions, offering visibility that was previously unattainable. Additionally, they integrated this data with Salesforce, ensuring usability throughout the organization.

In the Clients' Words

Impact and Results

The Finance Team

By centralizing their contracts in Knowable’s easy-to-search Contract System of Record (CSOR) the Head of Finance Transformation was able to get portfolio level view of payment terms and immediately find missing revenue in the following areas:

Billing Errors: A customer was incorrectly billed annually instead of monthly, resulting in over $200,000 of lost revenue.

Renewal Oversight: They identified Annual Automatic Renewals (AARs) with YoY price increases under the company’s standard increase rate.

Policy Discrepancies: They detected inconsistent positions across business units.

These insights resulted in the Finance team generating incremental revenue and achieving greater accuracy in revenue forecasting, which caught the attention of the Commercial Sales team. Despite having numerous sales tools at their disposal, they struggled to find specific customer terms quickly, which often caused delays and missed deadlines during the renegotiation phase.

The Sales Team

Like the Finance team, the Sales team is strategically concentrated on generating revenue. Additionally, they aim to achieve incremental cost savings, enhance sales productivity, and improve process efficiency, but how those goals are achieved varies by department.

The Sales team frequently encountered an issue with customer usage exceeding their contracted limits. As a global data analytics firm offering a subscription-based service that compiles data from key business and media sources, they provide data to clients on a per-seat basis. Each seat allows for a specific amount of usage, which incurs a real cost to the business. A substantial increase in usage often indicates that users are sharing their logins with team members, an action that violates the terms of the agreement, but on the upside, demonstrates the potential to add new seats to the contract.

Unfortunately, the company lacked an automated system to effectively monitor client usage and therefore failed to bill for overages, despite it being stipulated in their contracts. By the time they learned of these overages, it was too late to bill clients retroactively and recover the lost revenue. They needed a more efficient method of synchronizing their billing with the actual usage to upgrade customers at the correct time.

Mid-Market Sales Team Use Case

To solve this problem, the VP of Sales implemented a novel practice. They started executing a “high-use play” by analyzing weekly usage reports to identify accounts that were exceeding their platform usage limits. This report, however, does not show the number of licensed users, which was information that could only be found in the contract. To combat this, they compared the number of user IDs each account had against the number they were paying for and used contract language to upsell the customer.

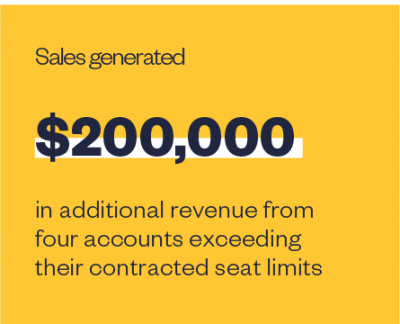

Within 60 days, the team identified several accounts over-utilizing their licenses, resulting in nearly $200,000 in additional revenue from four contracts. They continue to use this approach to create new “plays” that will leverage contract data for upsells and cross-sell opportunities.

Enterprise Sales Team Use Case

The VP of Enterprise Sales had similar goals for increasing revenue but needed a better system for transferring account intelligence since accounts were reassigned to new reps each year. Understanding the historical context of these large, complex multi-million-dollar agreements was critical for building and maintaining the relationships. Although this information was typically stored in Salesforce, accessing it required going through each individual agreement —a task that was quite overwhelming for those without a legal background and others who simply didn’t want to spend their time opening agreements and reading them if there was a faster way.

By leveraging Knowable, the sales team was able to significantly improve everyday operational efficiency in several ways:

They could narrow their search based on agreement status (active/inactive/unknown) to streamline the process of locating specific contracts.

With just a few clicks, they could see the historical relationship of an account, including any contractual changes.

They could quickly search specific terms that had been previously agreed to across all contracts, a task that was unfeasible before implementing Knowable.

And, given their data model, the sales team continue to achieve these insights without having to manually open and review each agreement, saving hours of time.

By analyzing auto-renewal data, the sales team identified which accounts changed to one-year terms after the initial contract period ended. Their goal was to identify AAR that would renew under their growth target and convert them to a fixed term at market value where appropriate. Given the large profile accounts they manage, it is essential to have a lead time of 3–6 months to ensure profitability. This lead time also provides the Enterprise Sales team with an opportunity to identify and address any issues with the relationship before the renewal period, such as over-utilization. Conversely, if the deal size fell below their annual YoY target, they could strategically decide whether to pursue a multi-year renewal, AAR or fixed term.

Another benefit for the Enterprise Sales team was their ability to review contracts post-acquisition or merger. With Knowable, they could effortlessly locate contract families and understand the terms and obligations, including payment terms and billing that would impact revenue. This was important for increasing revenue should the new parent company allow for product and user additions via email only approvals.

Outcome

Leveraging contract data has revolutionized the way this global enterprise operationalizes its Finance and Sales departments around revenue targets. By implementing insights derived from contract data, Finance and Sales have found creative ways to meet their goal of driving incremental revenue using contract data. In doing so, they have:

- Revenue Recovery and Forecasting Precision: Through centralized contract management, the Finance team recouped over $200,000 in missed revenue, chiefly attributed to billing errors, renewal oversights, and policy inconsistencies. This newfound accuracy also bolstered revenue forecasting capabilities.

- Enhanced Sales Efficiency and Revenue Growth: By leveraging contract data, the Sales team streamlined processes, identified overages, and upsold services to clients, resulting in nearly $200,000 in additional revenue within 60 days. This approach not only boosted revenue but also optimized sales productivity and is repeatable as it is now being implemented across other business units.

- Operational Efficiency and Time Savings: Implementation of Knowable led to significant time savings for both Finance and Sales teams. Streamlined contract access and automated usage monitoring reduced manual efforts, enabling quicker decision-making and freeing up resources for strategic initiatives.